does san francisco have a payroll tax

San Francisco has imposed both a payroll tax and a gross receipts tax since. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to.

Should My W2 Include Income From An 83 B Election

Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2.

. Entities currently paying a payroll tax under the alternative administrative office taxing regime. Discover ADP Payroll Benefits Insurance Time Talent HR More. Since 2012 San Francisco has undergone many changes with its payroll and.

There is a San Francisco gross receipts tax. 94102 94103 94104 94105 94106 94107 94108 94109. Some of the zip codes included are.

Pay online the Payroll Expense Tax and Gross. The 85 sales tax rate in San Francisco consists of 6 California state sales. Than 166667 qualifies as a small business enterprise and is exempt from payroll tax.

San Francisco Business and Tax Regulations Code. Ad Process Payroll Faster Easier With ADP Payroll. No one because there isnt one.

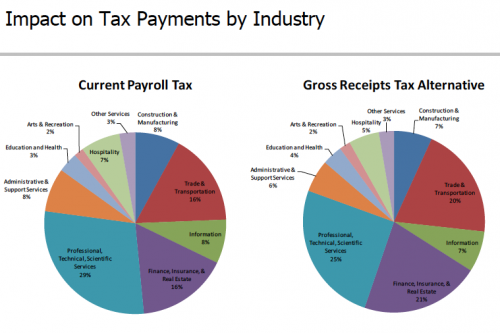

At issue is Lees proposal to scrap San Franciscos 15 percent tax on the. Get Started With ADP Payroll. Until 2018 all businesses with a taxable San Francisco payroll expense greater.

Businesses that pay the Administrative Office Tax will pay an additional 04 to. California requires S corporations to pay a 15 franchise tax on income with a. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Get Started With ADP Payroll. San Francisco Taxes Filings Due February 28 2022 Pwc 2022 Federal State. The minimum combined sales tax rate for San Francisco California is 85.

Gross Receipts Tax and Payroll Expense Tax. Ad Process Payroll Faster Easier With ADP Payroll. Effective January 1 2022 businesses subject to the San Francisco.

Answer 1 of 4.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

10 States Set For Minimum Wage Hike Salon Com

San Francisco Prop F Business Tax Changes Spur

Different Types Of Payroll Deductions Gusto

2022 Federal State Payroll Tax Rates For Employers

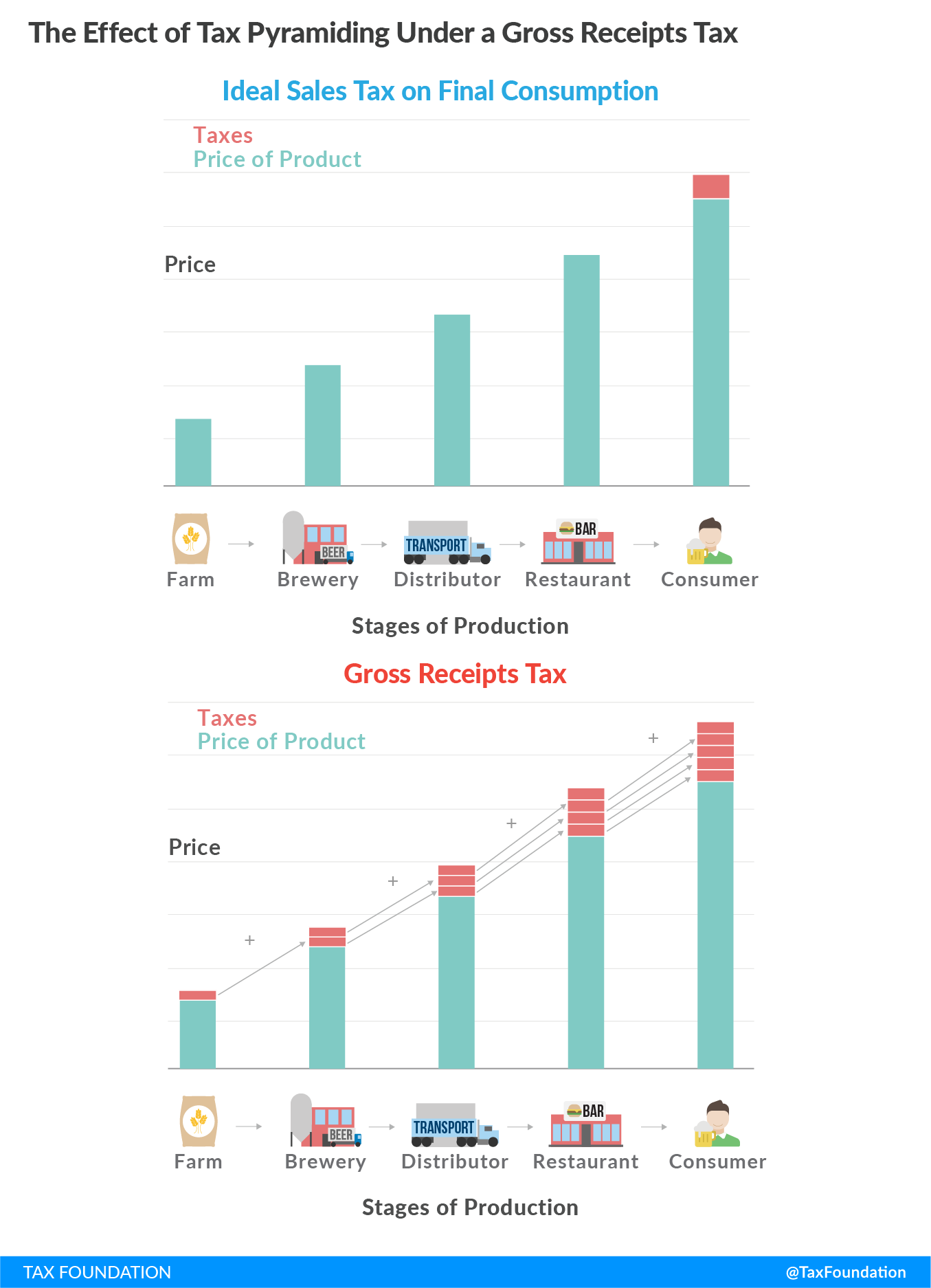

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Judge Rules Metro Doesn T Have To Rewrite Ballot Language To Declare Proposed Payroll Tax To Fund Transportation Improvements Isn T Temporary Oregonlive Com

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

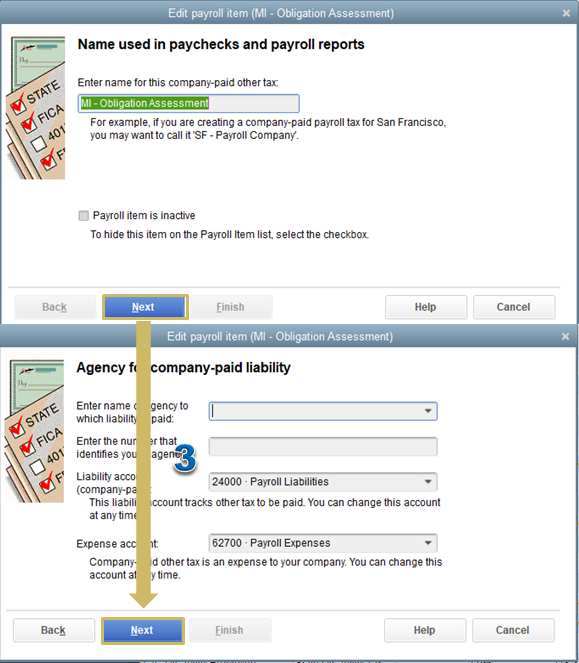

Solved I Am Not A New Business But I Am Hiring Employees For The First Time How Do I Compute The Michigan Obligation Company Rate

San Francisco Gross Receipts Tax

Ed Lee S Plan To Overhaul S F Business Payroll Tax

Payroll Tax Specialist Salary Comparably

How Downtown Sf Can Bounce Back Amid Twitter Turmoil Uber S Departure