ev charger tax credit federal

This is a one-time. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of.

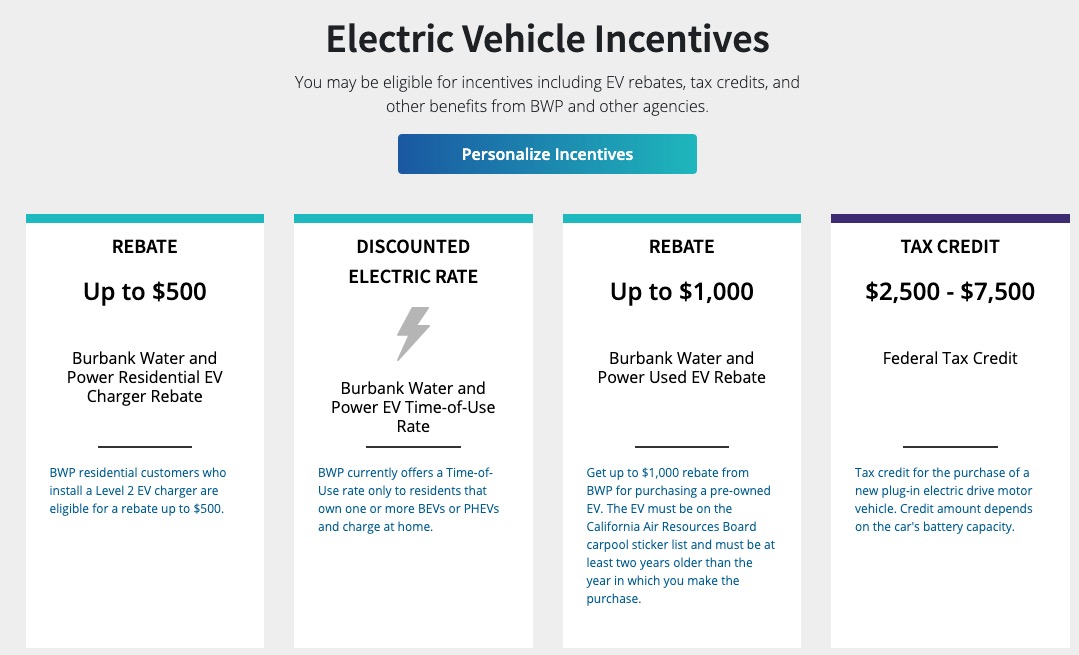

Federal Tax Credits for New All-Electric and Plug-in Hybrid Vehicles Federal Tax Credit Up To 7500.

. For example the 2022 Tesla Model 3 can take. The current lineup of GM EVs like the Chevrolet Bolt EV doesnt qualify for the credit. Here are the key things to know.

Illinois offers a 4000 electric vehicle rebate instead of a tax credit. Electric Vehicles Solar and Energy Storage. General Motors is another automaker that is ineligible for the tax credit.

For residential installations the. The federal tax credit covers 30 of an EV charging station necessary equipment and installation costs. Central Lincoln 250 rebate for purchase of home EV charger.

Illinois offers a 4000 electric vehicle rebate instead of a tax credit. Homeowners who install EV chargers on their property also qualify for a tax credit. Reduced Vehicle License Tax and carpool lane access.

Taxpayers are eligible for a credit of 30 of the hardware and installation costs for EV chargers installed in their homes after December 31 2021. This is the same as what it used to be. Iowa EV tax rebate.

EV tax credit for new vehicles. The new 7500 EV tax credit formally known as the. EV tax credit for new vehicles EV tax credit for used vehicles EV charger credit Frequently Asked Questions.

Central Lincoln offers residential and commercial customers a rebate of 250 to purchase a Level 2 EV. About Form 8911 Alternative Fuel Vehicle Refueling Property Credit Use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a.

The credit is for 30 of the combined cost of the hardware and installation capped at 1000. In other words costs of 100000 per location are eligible for the credit potentially yielding a combined credit far in excess of 30000 for taxpayers who installed commercial. Maine electric vehicle rebates.

Maryland offers a tax credit up to 3000 for qualified. More Information Plug-In Electric Drive Vehicle Credit IRC 30D The 30D a credit is. The credit remains the same under.

A recently expired tax break for electric vehicle EV chargers got new life under the recently passed Inflation Reduction Acta move that will give taxpayers up to 1000 in a tax credit. It applies to installs dating back to January 1 2017 and has. Florida electric vehicle rebates.

District of Columbia DC offers electric vehicle tax exemptions instead of credit. Up to 1000 state tax credit Local and Utility Incentives. How much is the US federal tax credit for EV chargers.

The federal 2020 30C tax credit is the largest incentive available to businesses for installing EV charging stations. These requirements make it so that very few EVs and plug-in hybrids qualify for the federal tax credit and the Charge Up rebate. The credit is 10 of the purchase price of the vehicle with a maximum credit of 2500.

The tax credit covers both hardware and installation costs.

Minnesota Ev Tax Credit Everything You Need To Know In 2022

How Do Electric Car Tax Credits Work Credit Karma

Charged Up For An Electric Vehicle Future Pirg

Electric Vehicle Buyers Want Rebates Not Tax Credits Media Relations The George Washington University

U S Says About 20 Models Will Get Ev Credits Through End Of 2022 Reuters

Electrification Coalition Inflation Reduction Act Impacts On Electric Vehicles

Ev Charging Equipment Tax Credit Extended Solar Electric Contractor In Seattle Wa 206 557 4215

Federal Tax Credit On Ev Charging Equipment Approved Plug In America Trains Dealers To Better Serve Ev Customers

Federal Tax Credits Are Finally Coming Back But There Is A Lot To Sift Through Green Auto Market

Southern California Edison Incentives

Maximize 2021 Electric Vehicle Charging Station Tax Credits Wipfli

How To Claim The Federal Tax Credit For My Home Electric Vehicle Charging Station

Can I Get A Tax Credit For An Ev Charger In New York Roy S Plumbing Heating Cooling

How To Get The Federal Ev Charger Tax Credit Forbes Advisor

The Federal Tax Credit For Electric Vehicle Chargers Is Back Eq Mag Pro The Leading Solar Magazine In India

Rebates And Tax Credits For Electric Vehicle Charging Stations

Ev Purchase Incentives Need To Shift To Point Of Sale Rebates